ATM blank cards represent a significant threat to financial security. These cards, essentially blank templates awaiting fraudulent activation, are increasingly used in sophisticated schemes to drain bank accounts and cause widespread financial damage. Understanding the methods employed by criminals, the legal ramifications, and the preventative measures available is crucial in combating this evolving form of financial crime.

The illegal trade of these blank cards thrives in the digital shadows, facilitated by online marketplaces and encrypted communication channels. Criminals exploit vulnerabilities in ATM systems and card security protocols to clone legitimate cards or create entirely counterfeit ones. The consequences can be devastating for both individuals and financial institutions, leading to substantial financial losses and reputational damage.

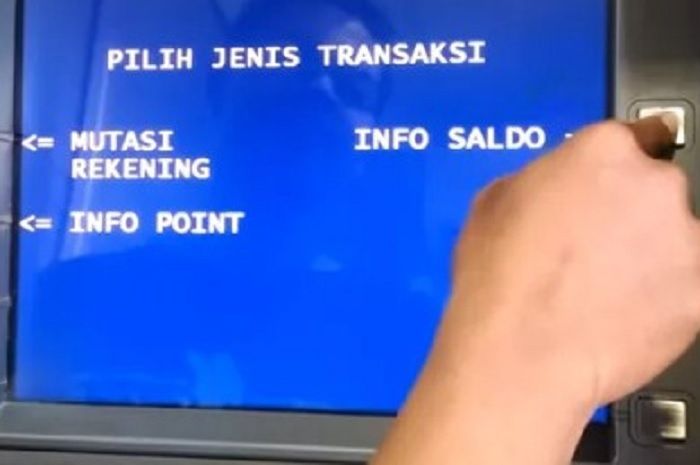

ATM Card Security Risks

Source: tempo.co

Reports of ATM blank card scams are increasing, prompting concerns about financial security. Individuals seeking alternative income streams might consider legitimate opportunities, such as those advertised on sites like big island craigslist farm and garden , which lists various farming and gardening jobs. However, caution remains paramount when dealing with unknown parties, even in seemingly legitimate contexts, to avoid becoming a victim of ATM blank card fraud.

The proliferation of blank ATM cards in the illicit market presents significant security risks to financial institutions and individuals. These cards, essentially pre-made but unactivated cards, are susceptible to various forms of fraud and compromise the integrity of the entire ATM network. Understanding the vulnerabilities associated with blank ATM cards is crucial for implementing effective preventative measures.

Common ATM Card Security Vulnerabilities

Blank ATM cards, by their nature, lack the crucial security features of a legitimate card. This absence of pre-programmed data makes them prime targets for exploitation. Common vulnerabilities include the potential for unauthorized data injection, cloning of existing cards onto the blank, and the use of sophisticated skimming devices to obtain card details for subsequent activation. The ease with which blank cards can be programmed and activated is a major security concern.

Fraudulent Activities Using Blank ATM Cards, Atm blank card

Blank ATM cards are instrumental in various fraudulent activities. Criminals can use them to withdraw cash, make purchases, or transfer funds illegally. They can load stolen card data onto the blank cards, effectively creating counterfeit cards that appear legitimate to ATM machines. This can result in significant financial losses for both individuals and banks.

Methods for Creating and Activating Counterfeit ATM Cards

The creation and activation of counterfeit ATM cards involve sophisticated techniques. Criminals often use specialized software and hardware to write stolen card data onto blank cards. This process can involve magnetic stripe duplication, chip cloning, or even the direct manipulation of the card’s internal microchip. Activation often requires accessing compromised databases or using techniques to bypass security protocols.

Comparison of Security Features in Various ATM Card Types

Different ATM cards offer varying levels of security. Magnetic stripe cards are the least secure, while EMV (Europay, MasterCard, and Visa) chip cards offer significantly enhanced protection against fraud. Contactless cards, while convenient, also present unique security challenges. The introduction of biometric authentication and tokenization technologies further strengthens card security, but these technologies are not universally adopted.

Types of ATM Card Fraud

| Fraud Type | Method | Impact | Prevention |

|---|---|---|---|

| Card Cloning | Copying data from a legitimate card onto a blank card. | Financial loss for the cardholder. | Regularly monitor bank statements, use EMV chip cards, and avoid using ATMs in suspicious locations. |

| Skimming | Using a device to steal card data from an ATM. | Financial loss for multiple cardholders. | Cover the keypad when entering your PIN, be wary of suspicious ATM attachments, and use ATMs in well-lit, secure locations. |

| Data Breach | Stealing card data from a financial institution’s database. | Financial loss for many cardholders. | Financial institutions should implement robust security measures to protect their databases. |

| Phishing | Tricking individuals into revealing their card details online. | Financial loss for the cardholder. | Be wary of suspicious emails and websites, and never share your card details online unless you are certain of the website’s legitimacy. |

Legal and Ethical Implications

The possession and use of blank ATM cards carry significant legal and ethical consequences. Understanding these implications is crucial for both individuals and financial institutions to prevent and combat this form of financial crime.

Legal Ramifications of Possessing or Using a Blank ATM Card

Source: go.id

The legal ramifications of possessing or using a blank ATM card vary depending on jurisdiction. In many countries, it is a criminal offense to possess tools or instruments intended for fraudulent activities, including blank ATM cards. Penalties can range from fines to imprisonment, depending on the severity of the offense and the amount of financial loss involved.

Ethical Considerations Surrounding Blank ATM Cards

The creation and distribution of blank ATM cards are ethically reprehensible. It involves the deliberate circumvention of security measures and the potential for causing significant financial harm to individuals and institutions. The ethical responsibility lies in upholding the integrity of the financial system and protecting the interests of all stakeholders.

Legal Penalties for ATM Card Fraud Across Jurisdictions

Legal penalties for ATM card fraud vary significantly across different jurisdictions. Some countries have stricter laws and harsher penalties than others. Factors such as the amount of money involved, the sophistication of the fraud, and the offender’s criminal history all influence the sentencing.

Real-World Cases Involving Blank ATM Cards

Numerous real-world cases demonstrate the devastating consequences of blank ATM card fraud. For instance, a large-scale operation involving the use of blank ATM cards in several European countries resulted in millions of dollars in losses and lengthy prison sentences for the perpetrators. These cases highlight the need for strong security measures and robust law enforcement.

Ethical Responsibilities of Financial Institutions

- Implement robust security measures to protect card data.

- Regularly update security protocols to counter evolving threats.

- Educate customers about ATM card security risks and best practices.

- Invest in advanced fraud detection technologies.

- Collaborate with law enforcement agencies to combat ATM card fraud.

Technical Aspects of ATM Card Functionality

Understanding the technical aspects of ATM card functionality is essential for comprehending how blank ATM cards can be exploited. This section delves into the technical processes involved in ATM transactions and the vulnerabilities within the system.

ATM Card Authorization and Transaction Processing

An ATM transaction involves a complex interplay of technologies. The card is inserted, the PIN is verified, and the request is sent to the bank’s processing system. The bank verifies the account balance and authorizes the transaction. The entire process is heavily reliant on secure communication protocols and encryption to protect sensitive data.

Data Stored on an ATM Card

ATM cards store crucial information, including the cardholder’s account number, expiration date, and security features like a CVV (Card Verification Value) or chip encryption data. This data is used for authentication and authorization during transactions. The security of this data is paramount to preventing fraud.

Technologies Used to Secure ATM Cards

Several technologies are used to secure ATM cards against unauthorized access. EMV chip cards use encryption to protect card data, making them more secure than magnetic stripe cards. Tokenization replaces sensitive card data with unique tokens, reducing the risk of data breaches. Biometric authentication adds an extra layer of security by requiring fingerprint or facial recognition.

Potential Vulnerabilities in the ATM Card System

Despite these security measures, vulnerabilities remain. Weaknesses in software, hardware, or communication protocols can be exploited by criminals. Skimming devices can capture card data, and malware can steal information from ATMs or point-of-sale systems. Blank cards can be used to exploit these vulnerabilities.

Flowchart of a Typical ATM Transaction

A typical ATM transaction involves the following steps: Card insertion -> PIN entry -> Authentication -> Transaction request -> Authorization -> Funds disbursement -> Transaction completion. Points of vulnerability include the PIN entry process (shoulder surfing, keyloggers), the communication link between the ATM and the bank (interception of data), and the ATM itself (compromised software or hardware).

Prevention and Mitigation Strategies

Preventing and mitigating the risks associated with blank ATM cards requires a multi-pronged approach involving individuals, financial institutions, and technology providers. This section Artikels strategies to enhance security and reduce the likelihood of successful fraud attempts.

Measures Individuals Can Take

Individuals can take several steps to protect themselves from ATM card fraud. These include regularly monitoring bank statements for unauthorized transactions, using strong and unique PINs, being cautious of suspicious ATMs, and shredding old cards to prevent data recovery.

Best Practices for Financial Institutions

Financial institutions should implement robust security measures, including regular security audits, employee training, and advanced fraud detection systems. They should also invest in EMV chip card technology and promote the use of more secure authentication methods.

Role of Technology in Mitigation

Technology plays a crucial role in mitigating the risks. Advanced encryption techniques, tokenization, and biometric authentication can significantly enhance security. Artificial intelligence and machine learning can be used to detect fraudulent transactions in real-time.

Improving Security Protocols

Security protocols can be improved by strengthening authentication processes, implementing multi-factor authentication, and enhancing data encryption standards. Regular software updates and security patches for ATMs and point-of-sale systems are crucial.

Security Measures Table

| Security Measure | Description | Effectiveness | Implementation Cost |

|---|---|---|---|

| EMV Chip Cards | Cards with embedded microchips for enhanced security. | High | Moderate |

| Multi-Factor Authentication | Requiring multiple authentication methods (e.g., PIN and biometric). | High | High |

| Tokenization | Replacing sensitive card data with unique tokens. | High | Moderate |

| Regular Security Audits | Periodic assessments of security vulnerabilities. | Moderate | Moderate |

The Black Market for Blank ATM Cards

Blank ATM cards are actively traded on the black market, facilitated by various online platforms and channels. Understanding the dynamics of this illicit market is crucial for effective law enforcement and prevention strategies.

Distribution and Sale Methods

Blank ATM cards are distributed through various channels, including online forums, dark web marketplaces, and social media groups. Dealers often use encrypted communication methods and employ techniques to conceal their identities and operations.

Online Platforms and Channels

The illegal trade of blank ATM cards leverages the anonymity offered by the dark web and encrypted messaging platforms. Dealers utilize forums and marketplaces to advertise their products, often employing coded language to evade detection by law enforcement.

Price Range and Payment Methods

The price of blank ATM cards varies depending on factors such as the card type, security features, and the quantity purchased. Payment methods often involve cryptocurrencies to maintain anonymity and avoid traceability.

Key Players and Participants

The black market for blank ATM cards involves a complex network of individuals and groups. This includes card manufacturers, data thieves, distributors, and end-users. The collaborative nature of these operations poses significant challenges to law enforcement.

Stages of the Black Market Process

The black market process typically involves several stages: Acquisition of blank cards -> Data acquisition (stolen card details) -> Card programming -> Distribution/sale -> Fraudulent use -> Money laundering. Each stage presents opportunities for law enforcement intervention.

Last Recap: Atm Blank Card

The pervasive threat of ATM blank cards highlights the ongoing battle between criminals and financial institutions to secure personal and institutional funds. While technological advancements offer enhanced security measures, vigilance and proactive strategies remain paramount. Individuals need to remain aware of potential threats and adopt responsible practices, while financial institutions must invest in robust security systems and robust fraud detection mechanisms.

The fight against ATM blank card fraud is a continuous process requiring constant adaptation and collaboration.